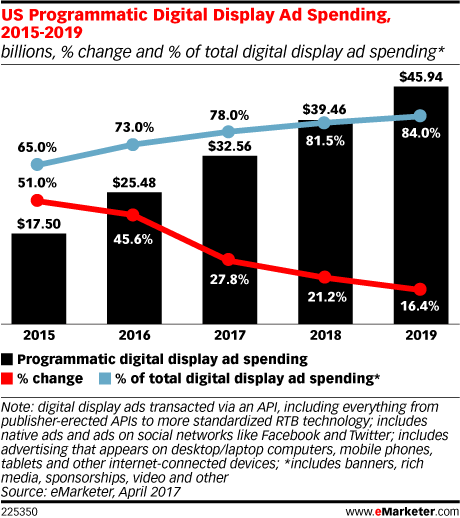

A new forecast by eMarketer estimates that “four of every five” US digital display ad dollars (78%) will transact programmatically in 2017, accounting for a total spend of $32.56 billion.

By the end of the forecast period, it’s predicted that this share will rise to 84%.

EMarketer has arrived at the lofty figures despite recent bad press surrounding programmatic generated by the YouTube controversy, but claims there’s “little doubt” that buyers and sellers will continue to invest in automated ad buying, adding, “the desire and need for greater control are moving them toward more private setups”.

Going private

Amidst this growth, the researchers note a move away from open exchanges to private marketplaces, with already 74.5% – or $24.25 billion – of total US programmatic display ad spend trading on private marketplaces and programmatic direct setups.

The share of purchases made via programmatic direct is growing and set to take 50% of spend by the end of the year while 44% will be bought via real-time bidding. On the other hand, the share of spend made on open exchanges is seeing a decline.

“Private setups give buyers and sellers greater control over their automated buys,” said eMarketer’s principal analyst, Lauren Fisher.

“They may have initially served to bring in reticent buyers and sellers, but now private setups drive much of the change and momentum in the marketplace, as both parties seek greater control from their programmatic efforts.”

Following similar findings in the UK, the report forecasts that video inventory will see a rapid hike in automated trading. In 2016, more than half of all US online video spend was traded automatically; this portion is set to grow another 42.3% this year to $9.13 billion, while in 2018, nearly three-quarters of all video ad dollars will be traded programmatically.