The UK’s digital ad industry attracted £10.304 billion in spend last year, according to an annual study by the IAB and PwC, with mobile advertising and advances into video proving key drivers.

That figure represents a 17% like-for-like increase on 2015, while driving much of that growth mobile saw a staggering 50.8% increase on last year to be worth £3.86 billion. That means mobile now accounts for 38% of all digital ad spend, compared to 4% just five years ago.

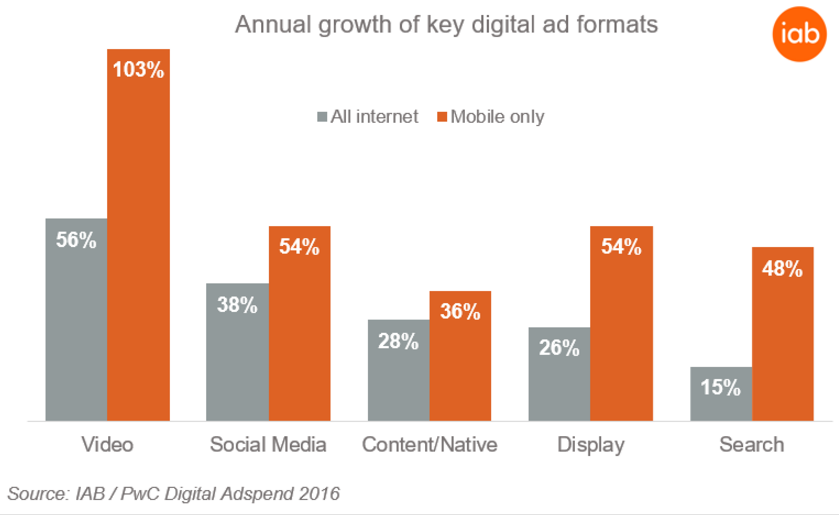

Hand in hand with the success of the smaller screen is video, content & native and social media advertising, where mobile accounts for 63%, 76% ad 79% of total spend respectively, with almost half (48%) of UK internet time estimated to now take place on smartphones.

Focusing particularly on mobile video, the channel witnessed a 103% year-on-year growth in ad spend, making it the fastest growing ad format within the period and contributing close to a third (29%) of the total growth in digital ad spend.

Commenting on the results, the IAB’s chief marketing officer, James Chandler, praised the digital marketing industry’s members for increasingly adopting mobile video following another year plagued by doubts over consumer experience, following the ongoing rise of ad blocking.

“Reaching the £10 billion threshold has been made possible by brands breaking the mould, trying innovative formats and making the most of video to reach and amaze people,” said Chandler.

Programmatic’s ascent

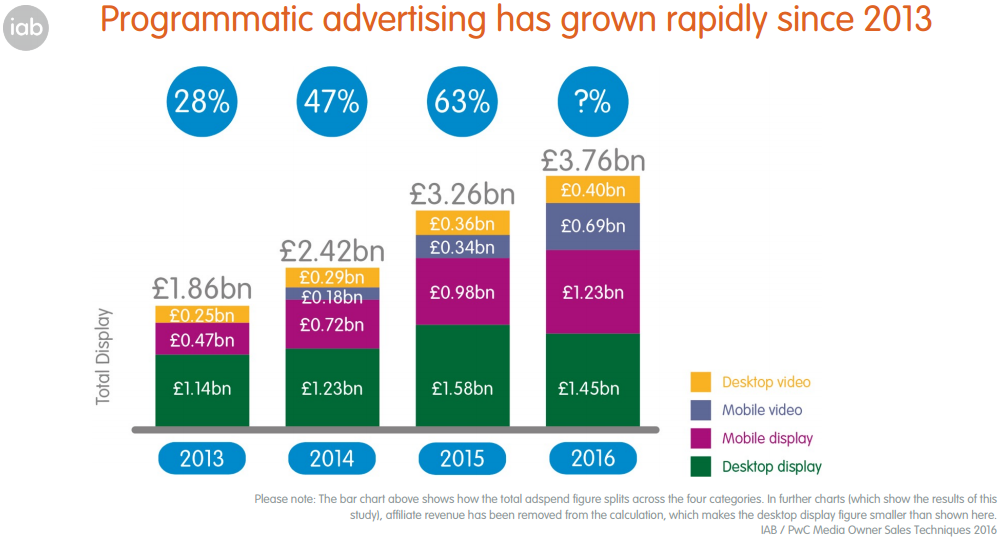

The results of the report also shed some light on stats around programmatic. The automated ad-buying format has developed at a blistering pace within the last few years, growing from an experimental use to an industry worth £3.6 billion in 2016, and one that now syphons 72% of all display ad budgets in the UK, according to the research.

Desktop display continues to drive the majority of spend on programmatic at £1.45 billion, while mobile display is catching up, increasing 83% to account for £1.23 billion. Once again, the mobile video market is also driving a sizeable portion of this increase.

PwC’s senior manager, Dan Bunyan, also notes the growth of programmatic direct – which has sprung 49% on 2015 against indirect’s 24% – as one of the most significant trends given recent concern over ad placements.

“Right now, considerations such as brand safety mean the advertiser is rightly demanding more certainty in the placement of their ads and the industry is evolving quickly to find new solutions to address brands’ needs in this dynamic environment,” he explained.

The report highlights that with improved technology, changing attitudes towards data gathering and generally wider adoption of programmatic, the technology will continue to develop in the next three years, with the researchers forecasting automated buying to account for as much as 80-90% of display ad spend in 2019.

”It’s impossible to ignore the issues the industry is facing at the moment, but digital never stands still and these figures are testament to the long-term strength and power of digital,” Chandler added.