A new report by eMarketer estimates that 79.9% of China’s programmatic ad spend went to mobile in 2017.

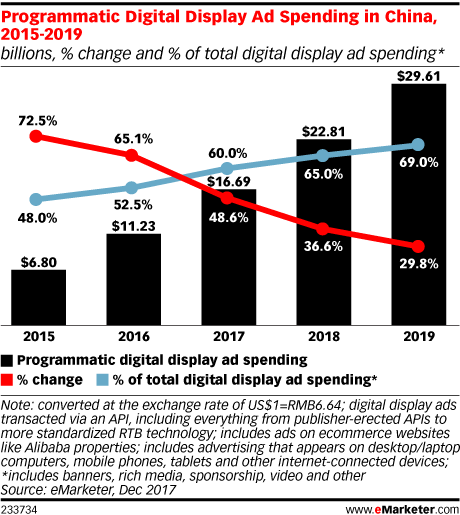

Meanwhile, with programmatic ad spend totalling $16.69 billion last year in the “mobile-first” market, spend on the ad-buying format has increased 48.6% since 2016.

According to the report, this growth is being driven by the ‘BAT’ companies: Baidu, Alibaba and Tencent, China’s internet and technology titans. These companies – the latter two of which are among the largest ten companies globally by market capitalisation – are dominating China’s digital ad economy and “casting a shadow” over competing small and medium-sized publishers.

Chinese dragons

By 2021, BAT companies are set to collect a combined share of 64.1% of digital ad expenditure in China, with Alibaba taking over 35% of that alone, followed by Baidu (18.4%) and Tencent (10.4%), according to a previous forecast by eMarketer.

The size of these publishers means they control advertising on their platforms, with most advertisers buying ads directly through one of the companies. In 2017, direct sales accounted for 63.5% of programmatic digital display, while real-time bidding represented 36.5%.

Despite the massive growth of programmatic in China within the last year, its 60% overall share of display ad spend is still some way behind figures from the US (78%) and UK (79%); eMarketer suggests that while advertisers in China have limited options for digital advertising, higher publisher competition in the US and UK powers more spending.