The UK might have witnessed the most significant ad spend growth between 2011 and 2016, but things are different now. The latest Zenith Ad Spend Forecast pins down the slowing economy, Brexit and gathering inflation as culprits behind a worsening ad spend situation. Although Britain’s market used to grow by 7.3% annually in 2011-2016 – reaching 9.6% last year – it’s expected the rate will drop to just 0.9% in 2017.

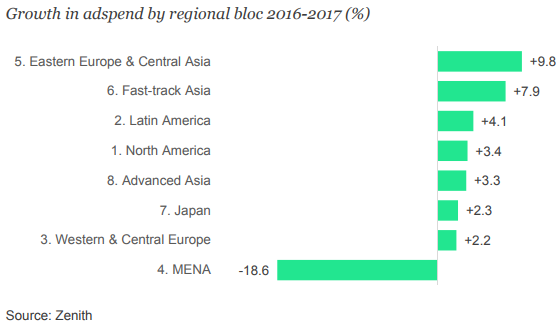

A key market for Western and Central Europe*, the UK contributed to a decrease in numbers for the region as ad spend fell from 4.5% in 2016 to 2.2% in 2017, and an annual average is expected to stay at 2.6% to 2019.

Conversely, things are looking up for Eastern Europe and Central Asia**. After a slowdown caused by political events in 2014 and 2015, including conflicts in Ukraine, oil price drop and sanctions on Russia, Zenith’s report predicts a huge increase in ad spend for the regions. While the rates shrunk 0.7% in 2014 and 8.2% the following year, 2016 brought recovery as spending grew 4.3%, an upward trend which continues to date. It’s expected Eastern Europe and Central Asia will become the fastest developing markets in the next couple of years, with a forecast of an average of 9.2% annual growth.

Political impact

“It’s been a delicate time in the region and across central Asia, with sanctions imposed on Russia and subsequent withdrawal of investment internationally, but reports show these difficulties had less of an impact on ad-spend than expected,” commented Taptica’s strategic partnerships lead, Amit Dar.

It was also the conflict in Ukraine, which resulted in sanctions in 2015, that had a noticeable impact on the market, according to Syzygy’s co-MD, Phil Stelter. He is, however, optimistic about the industry in the region, being certain they are a sign of a “buoyant economy” driving marketers to invest.

“Whilst there’s no doubt that Central and Eastern Europe (CEE) is playing catch-up with Western Europe, 7.3% represents astonishing growth,” he added.

Voluum’s MD, Gavin Stirrat, agrees the advertising ecosystem has been impacted by global events to a big extent. In his opinion, the financial crisis of 2008-2009 followed by the Eurozone crisis affected the European and Central Asian markets for the past nine years while the Western and Central Europe were impacted by “turbulent political market.”

Powered by mobile

Another factor driving speedy ad spend growth in Eastern Europe and Central Asia is, unsurprisingly, mobile.

“We’ve certainly seen an increase in mobile spend in this area, mirroring the continued smartphone penetration there,” explained Dar, “Russia, for example, has the biggest mobile market in Europe which has grown rapidly over the past few years, with mobile penetration spiking from just 34% in 2010 to over 70% now.”

Zenith’s report also highlighted that global mobile ad spend has been booming, estimating it increased 47% in 2016, following an 86% increase the year before. The study suggested that the average annual growth rate would climb to 25% a year between 2016 and 2019, which is powered by quick spread of devices and increasingly better user experience. Desktop, on the other hand, is expected to experience a 3% fall as advertisers will follow consumers on smartphones.

Stirrat highlights the trend reflects the growing importance of mobile as a touchpoint as it becomes generally acknowledged it’s no longer a “second screen” but the device users engage with most regularly.

Stelter concludes it’s “no wonder” Eastern Europe is experiencing growth.

“It’s home to approximately 455 million people, compared with just under 400 million in Western Europe. That’s a big audience that marketers can reach with increasing effectiveness as technology changes both the way consumers interact with brands and the manner in which brands can build relationships with consumers,” he explained.

“It will be interesting to see how ad spend in Eastern Europe and Central Asia continues to fare in comparison to Western Europe, whose own performance is down – partly down to weak UK growth from political uncertainty and a slowing economy,” added Dar.

For more information on advertising spend in different regions, read about trends in Latin America.

*Western and Central Europe: Austria, Belgium, Bosnia & Herzegovina, Croatia, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Netherlands, Norway, Poland, Portugal, Romania, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, UK.

*Eastern Europe and Central Asia: Armenia, Azerbaijan, Belarus, Bulgaria, Estonia, Georgia, Kazakhstan, Latvia, Lithuania, Moldova, Russia, Turkey, Ukraine, Uzbekistan.