On May 5 Google ran its Livestream 2015 event showcasing its new products. The thing that stood out the most was Google’s continued push into the price comparison space. I believe that these new Google products will eventually spell trouble for companies such as GoCompare, Compare The Market and Skyscanner.

Firstly let’s look at how price comparison websites make money…

CPC (Cost per Click) – They receive a fixed CPC every time they send user on to the end client’s website.

CPA (Cost per Acquisition) – They receive a fee per successful user that they send to the end client’s website. For example they could receive $100 for each user that they send to and end user website who successfully signs up to a car insurance policy.

Both these models rely on users coming to their sites and then being redirected to the end vendor to buy a product. Google comparison products are a major threat as they allow users to compare results without ever leaving the search engine.

What are Google’s comparison products?

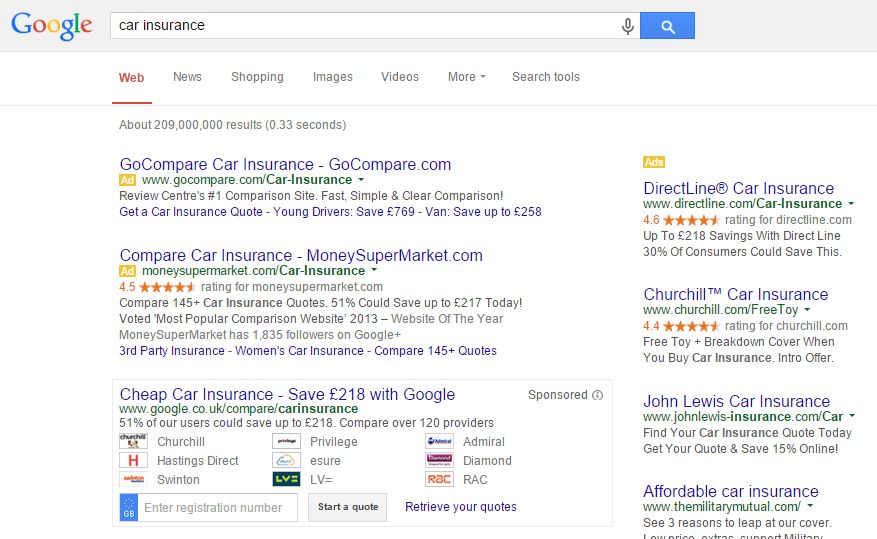

Google Compare Car Insurance

Google defines compare as “providing a seamless and intuitive experience for comparing multiple financial products side by side”. Early in 2015 Google launched car insurance comparison in California.

By providing car insurance comparison within the search engine’s results this will drastically cut the amount of users going to a car insurance comparison site. This consequently leads to a dramatic revenue drop for car insurance comparison sites.

Google is taking this a step further to launch insurer ratings. Each insurance company will be rated by Google’s users for across customer service, claim experience and recommended. The user will then be able to buy online directly from Google or click to talk directly with the insurance company.

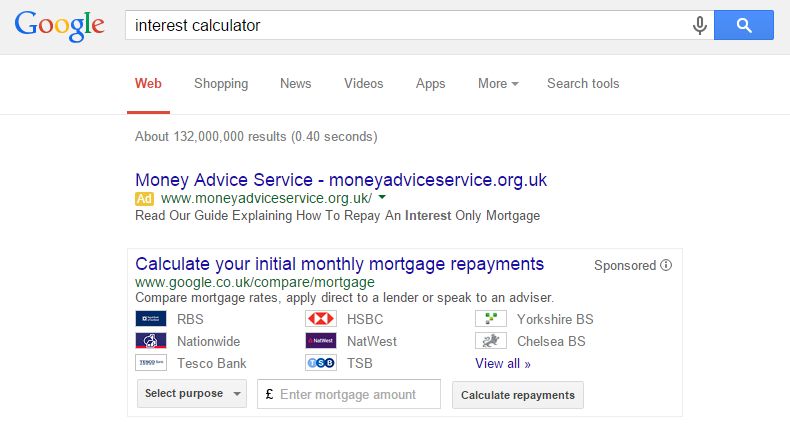

Mortgage ads

Google has recently launched a mortgage calculator in the organic search results, the first step on the road to them launching a mortgage comparison service.

Hitting the US later this year will be mortgage ads where users will be able to search on Google for the latest rates, look at all possible loan options (fixed / variable etc), see lender ratings and then buy all without visiting a comparison site.

Other comparison products that Google has launched include Hotel Ads and Credit Card Compare it’s obvious that Google sees the comparison space as a potential money maker.

What’s next?

Is Google going to launch a flight comparison engine to take on the likes of Skyscanner and Webjet? It is certainly easy to make the comparison between the above flight details and how Google has started to attack the mortgage market in the US with a mortgage calculator.

Can they be stopped?

The European commission has already accused Google of anti-competitive practices for its shopping related product set. The EU completion commissioner had this to say:

“Dominant companies have a responsibility not to abuse their powerful market position by restricting competition with others in markets where they are dominant or in neighbouring markets. Our preliminary view is that in its general search results, Google artificially favours its own company’s shopping service and that this constitutes an abuse.”

The EU feels that Google uses its market dominance to favour its own products. Personally, I have no problem with them displaying their own products, it is after all their own search engine, but I would be feeling quite nervous if I worked for or owned shares in a price comparison website.