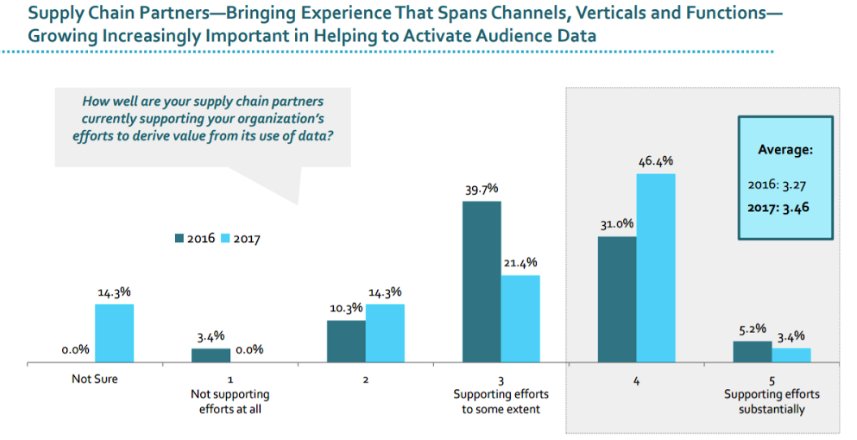

According to the Data-Centric Organisation survey, conducted by Winterberry Group in partnership with IAB (Interactive Advertising Bureau), data centricity is the most important waymark that organisations of all sizes and formats are planning to reach.

The majority of questioned publishers reported about their readiness to deploy data technologies and strategies that contribute to the omnichannel user communication in the near future. Advertisers have admitted that the creation of a robust user database improves basic marketing indicators and ROI. However, as information grows in volume and velocity, identifying the right data technologies and revenue streams become a real challenge, especially for publishers who act as the primary source of data providers.

Technologies and soft spots of data marketing

The abovementioned survey and several other sources point out the main challenges marketers face, while dealing with big data technologies, are related to the lack of comprehensive data modelling, segmentation, and attribution solutions that could be used without attracting big data and IT professionals.

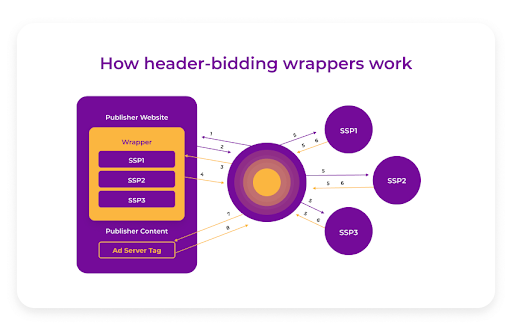

The trends, however, go on to say that such data management tools, like DMP (data management platform) have significantly evolved in the past couple of years. Today, publishers are able to gather customers’ digital footprints across mediums, channels, and verticals in order to personalise content and help advertisers activate it for better targeting. With modern technologies, like data aggregation and collection platforms, header-bidding wrappers, and app ads.txt inventory authorisation, it is possible to remove informational silos, increase profits with greater competition, and safeguard inventory from digital fraud.

1. Lookalike modelling with first and third party data

Personal data (first-party data) – is the most valuable asset of an organisation. Information of this sort is collected through the direct channels, like website, apps, proprietary CRM system, etc., and includes names, addresses, phone numbers, and purchase details. This data is aggregated by external platforms and sold via DMP (data management platform).

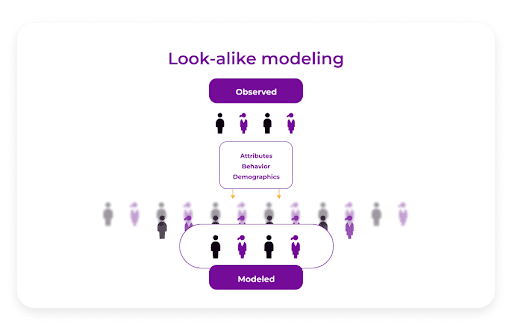

DMP is a cloud-based data management platform that accumulates first, second, and third party data from different sources. Subsequently, DMP segments the data and facilitates look-alike modelling execution on connected DSP (demand-side platform). Lookalike modelling takes into account the characteristics of the existing audience and finds new users who can potentially be interested in the same services or products.

In case DMP is connected to SSP (supply-side platform), the publishers use extended user data pool to adjust the website/app content to each user segment and personify the user experience.

As well, user data can become an additional source of income for app publishers. In this case, the data collected will include anonymous user data transmission from data applications to collectors. Any personal information about users, such as name, age, gender, or income is not transferred to third parties. To ensure that data monetization is carried out correctly, without violating GDPR, the publisher can cooperate with third-party vendors. Such vendors typically ensure that collected user data does not violate the GDPR policy. Usually, one vendor for one app is enough, but the publisher is the main collector of personal information who should always ask for the user consent before collecting their data.

2. Second-party data as a new revenue stream

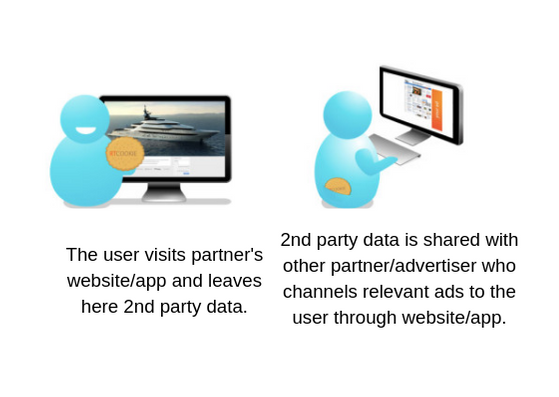

Second-party data involves information regarding marketing campaign results: activity, response, and other behavioural factors. Basically, it is first-party data that belongs to someone else, for instance, your partner or vendor. Typically, such data is not sold but shared among partners who have a similar audience.

While only 47% of organisations are able to potentially use their first-party data fully. The second-party data can fill the gap and play a significant role in targeting and audience extension. For example, a brand/advertiser that promotes professional sportswear can collaborate with blogs and publishers who develop apps devoted to a healthy lifestyle in order to find new customers, relying on social and demographic targeting.

This way, the publisher deals with the advertiser directly and thus, knows exactly what to expect from the future ad placements and which details should be negotiated beforehand. It’s worth pointing out, direct media-selling is also available for publishers in programmatic SSP (supply-side platforms). These platforms automate the process of media-selling via RTB (real-time bidding), but oftentimes, they also feature access to open marketplaces and non-programmatic private auctions.

3. In-app header bidding and app ads.txt

The summary of Mary Meeker’s Internet Trend Report has repeated the following statement again: advertisers are barely catching up with audiences who keep shifting their attention to the mobile ecosystem. Essentially, it leaves on the table a billion-dollar inventory monetisation opportunity for mobile app publishers. Header-bidding increases the profitability of mobile media trading by bringing together buyers who bid on inventory at the same time. On average, header-bidding features 30-40% higher CPM rates than waterfall. For top tier traffic, header-bidding publishers typically get from 80 cents to $5, depending on the geo, business vertical and the audience quality.

Advertisers benefit from such auctions as well, since they get the chance to buy the best quality inventory before it’s sold to someone else during sequential bidding. More good news for mobile advertisers is that IAB has launched a new version of ads.txt specifically for in-app in March 2019, which authorises mobile and OTT digital sellers and thus, protects the brands from advertising fraud.

Unified header-bidding auction is more difficult to execute in mobiles since it requires partner SDK integration. As a rule, publishers who work with multiple partners implement a client or server-side header-bidding wrappers, which makes it easy to delete and add new partners effortlessly, without meddling with code.

4. Enhanced audience segments as quality changes

For the publishers, the knowledge of who visits their website can be an additional point of growth in the long run. With essential data, demand parties have better chances to attract narrow audience niche advertisers and sell their inventory directly for a much higher price. Likewise, the readers will be grateful for content personalization that will positively impact click-through rates, open rates, sales, and customer lifetime value. Thoroughly analyzed audience segments will also help to develop a strategy for accepting branded content that always translates into higher traffic. Data management technology is the key that will help supply parties tune up user segmentation process in this case.

Apart of potential traffic augmentation bonuses, such technologies, like DMP, will bring to publishers additional user insights, which make it easier to predict their behaviour and figure out what placements will work for all particular types of ads on SSP.

The final thought

Robust data management technologies combined with working data strategy set publishers one step ahead in marketing planning. Modern data management technologies can analyze audience behaviour and adjust the changing conditions to ad tech and martech tools in order to increase their overall performance and engage customers during their lifetime journey. The key to success in all cases will be finding scalable strategies and solutions which are mutually efficient for supply and demand parties and users.