Ad spend growth in 2017 has slowed 1% since last year, according to Dentsu Aegis Network’s ”Ad Spend Forecasts” report.

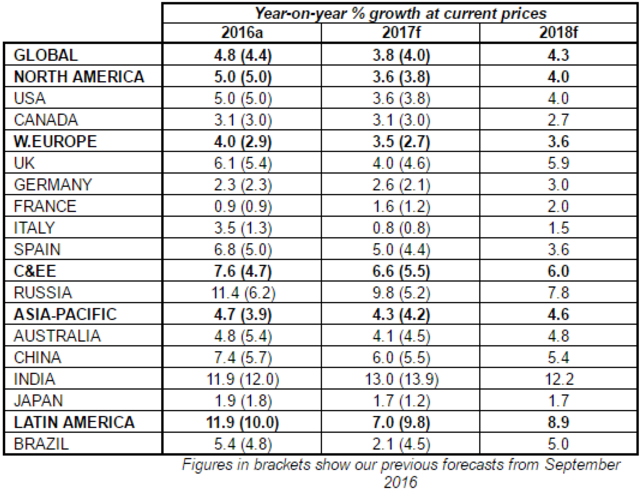

The findings came from research across 59 markets within the Americas, APAC, Europe and MENA, which revealed this year’s global $563.4 billion on spend to represent a dip in growth from 4.8% in 2016 to 3.8% this year.

However, while on a global level growth has lost some momentum, Dentsu is confident that the figure will rise to 4.3% in 2018, thanks to the Winter Olympics and Paralympics, FIFA World Cup and US congressional elections – all predicted to stimulate ad spend.

In the UK, Brexit didn’t affect ad spend rates as much as initially expected – after a fall from 6.1% last year to 4% this year, the study expects the rate to bounce back to 5.9% in 2018. A similar picture has emerged in the US, world’s largest market taking up 37.7% of global ad spend in 2017. With a slowdown to 3.6% this year, the US budgets are set to rise to 4% in 2018.

Digital revolution

On top of the numbers, the report also identifies certain trends; mobile is coming out strong this year acting as the primary device for entertainment among a third of consumers and is set to take a 56% share of global ad spend by the end of the year.

It’s also a turning point for TV advertising, with digital overtaking in global ad spend ranks for the first time, expected to shift from 34.8% this year to 37.6% in 2018, while TV stands to drop from 37.1% this year to 35.9% next year.

Much of digital advertising’s growth is down to online video, set to grow to 32.4%; social, with expected increase to 28.9%; and programmatic at a rate of 25.4%. Virtual reality, AI and voice activation aren’t big players just yet, but, according to the study, brands need to prepare for the new channels.

“Digital and data must now be the default settings for advertisers,” said Jerry Buhlmann, CEO of Dentsu Aegis Network.

“Evolving to people-based marketing rather than audience-based marketing and using data to increase addressability is essential for brands to manage tighter conditions in 2017 while positioning themselves for future growth.”