When it comes to apps and which types prove most fruitful for advertising budgets, a UK survey by measurement firm Verto Analytics has found that the most time, and an increasing amount of it, is spent on communications and social media.

Verto owes the findings to the increasing popularity of services such as Facebook, Whatsapp and Instagram, while the previously popular gaming vertical is seeing a distinct drop-off.

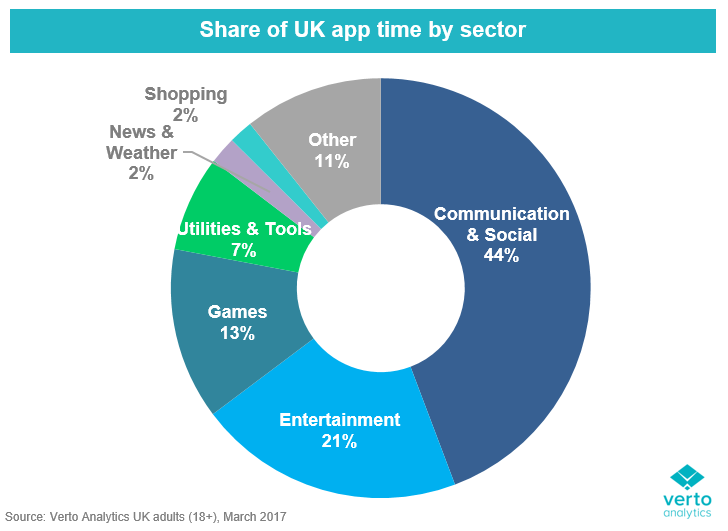

According to the study of 5,000 adults, time spent on social and communications apps has grown by 11.2 billion minutes (38%) from September 2016 to April this year, accounting for nearly half (44%) of all mobile app time, driven by the rise of messenger services and social networks angling towards mobile-first experiences.

Entertainment apps witnessed the second biggest rise throughout the same six-month period, climbing 22% and consuming one in every five (21%) app minutes. However, the historically well-performing gaming app category saw a 16% drop in time spent, resulting in app time falling from 18% to 13%.

“The continuous growth of messaging and social apps mean that the total app time is becoming dominated by just a few sectors, with the top three categories accounting for 78% of all mobile app time spent,” says Dr. Hannu Verkasalo, Verto Analytics’ CEO.

“This leaves the rest fighting over the scraps, which is going to get harder as app downloads are plateauing and there’s the impending rise of ‘hub apps’, where people do more tasks within one app – be it messaging, shopping or ordering a taxi.”

On the heels of social and entertainment apps, finance, photo & video and health & fitness categories followed, each pulling in more than half a billion minutes per month. Isolating finance, Verto puts growth down to innovations in peer-to-peer lending and mobile payment apps, which have seen greater acceptance and adoption among consumers in the last year.

However, Verkasalo is quick to point out the toughness of competition and grabbing user attention within the “clogged pipe” app market, with the average user having around 90 apps installed at one time, and 90% of users dropping off before 30 days of use.

“Getting people to download your app is only about 10% of the battle; app creators and the brands that advertise on them are under increasing pressure to be one of those crucial eight and stay there,” said Verkasalo.