UK display ad spend on mobile surpassed PC and tablet for the first time in H1 of 2016, scooping £802 million against £762 million from 2015.

To put that into perspective, 36p in every £1 spent on digital advertising now goes to mobile, up from 4p just five years ago.

This sharper focus on small screen marketing has lead to an increase in spend for digital advertising on the whole – up 16.4% within the same period. The market drove £4.78 billion between January and June, benefiting from the highest first-half growth rate for two years.

All of these findings come from the PwC / IAB UK Digital Adspend report, which attributed the “significant developments” to rapid growth in the time consumers spend on smartphones.

‘Everywhere ad platform’

The IAB’s theory is backed by findings by UKOM, revealing consumers spent 46% of their internet time on mobile in June 2016.

That was compared to 41% on a desktop or laptop, and for females specifically, the former figure rose to 52%, and 61% among 18-24s.

“Mobile use today is more akin to a computer than merely a phone, as people increasingly rely on them as their information, entertainment, and communications hub,” said the IAB UK’s chief strategy officer, Tim Elkington.

“People now spend more time online on their mobile than they do on a computer. Consequently, marketers devote more ad spend to mobile as they increasingly cotton on to the fact that people essentially carry an ad platform with them wherever they are.”

That includes first thing in the morning; YouGov consumer data revealing that 82% of smartphone owners check their phone within an hour of waking up – while 86% of 18-34s do so within half an hour – with catching up on social media the first thing one in five of these do.

Video on the up

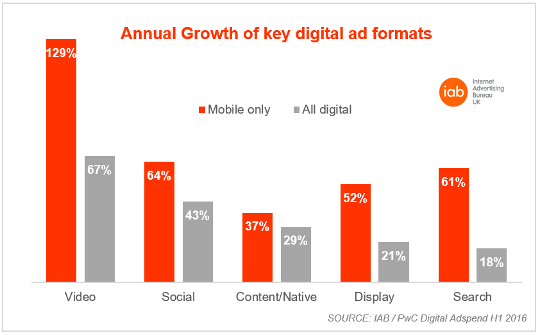

The Digital Adspend report goes on to reaffirm for the growth of video advertising in 2016, with spend on the channel growing 67% to hit £473 million during the first six months of the year.

As a consequence, video now accounts for 30% of all display advertising, and 37% of mobile display. Research also shines positively on outstream and in-read video ads, whose rapid adoption has been evidenced by acquisitions among many pioneers of late.

These formats saw a rise of 440%, taking a 40% chunk of video spend. Traditional video ads, which play before, during or after an online video, grew just 17%.

Social growth

Advanced targeting and ad options led by social networks are also showing signs of bearing fruit.

Social ad spend grew 43% in H1 to meet £745 million, taking nearly half (48%) of total display spend. Mobile alone can now claim an 80% stake in spend on social advertising.

Additionally, attention to mobile has also resulted in paid search growing 18.1%, totalling £2.49 billion – a 52% share of ad spend.

Consumer goods are the biggest investors in display advertising, according to the IAB & PwC; brands representing items such as food, toiletries, and clothing claimed 18.3% of total spend, while behind these were brands associated with travel & transport (16.4%) and the automotive industry (11.7%).