For all the various columns, 101s and best practice guides singing its praise, it seems programmatic advertising still has some work to do on the education front.

Despite the hype around the automated-buying technique, research by digital agency Theorem found programmatic to account for just 8% total media spend in the UK. As part of overall marketing spend, that figure falls to sub 1%.

The research conflicts with other studies, but raises a valid question.

However much it’s touted as a towering automaton, here to disrupt the digital ad industry for good, could it be that programmatic adoption isn’t the unstoppable tide it’s been made out to be?

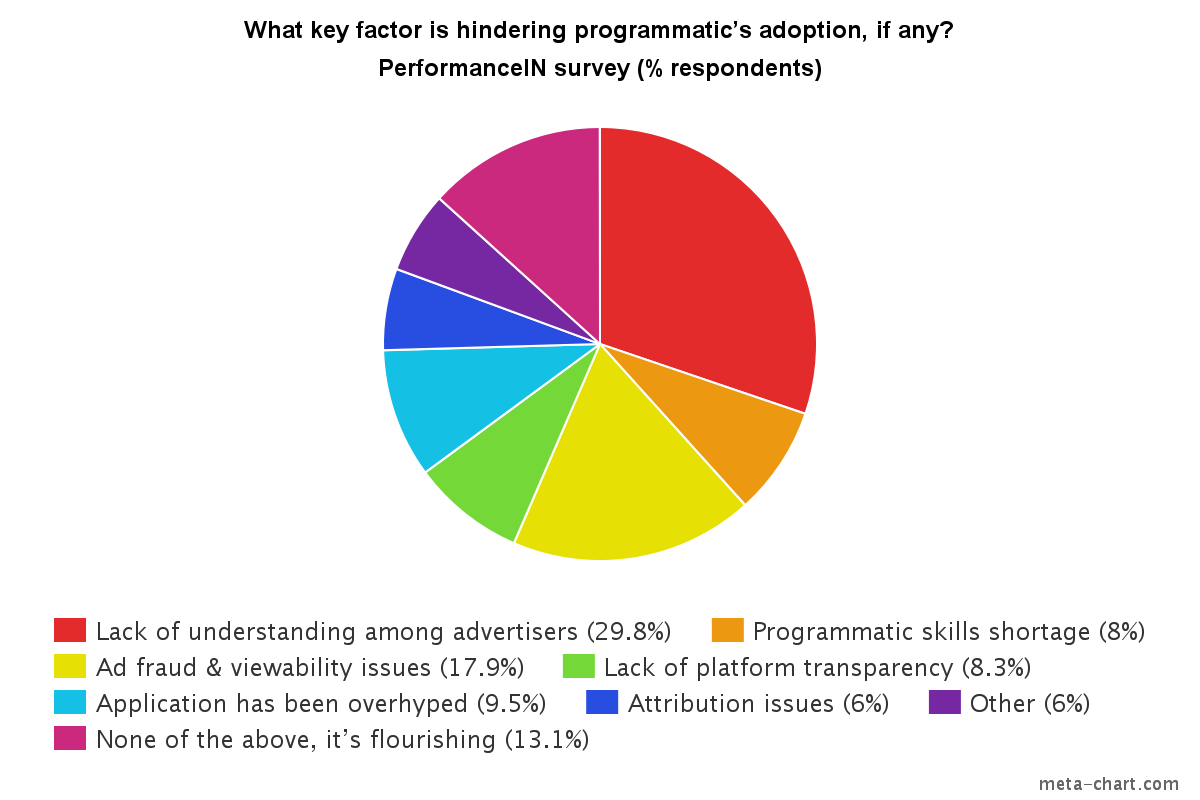

PerformanceIN asked approximately 100 of its performance marketing audience to see which key factors, if any, are hampering programmatic’s adoption. Here’s what they said:

Despite being given the opportunity to respond “None of the above, it’s flourishing”, just 13.1% chose this answer, indicating that just over one in ten marketers believe that programmatic, on its path to maturing, is facing no barriers.

Instead, the majority (29.8%), claimed that a lack of understanding among advertisers is showing itself to be programmatic’s key resistor. Given the ever-growing number of vendors and marketplaces that work within the channel, is the benefit of programmatic truly being explained adequately to potential clients?

“Almost a third of respondents to PerformanceIN’s survey on programmatic think that one of the key factors hindering its adoption is the lack of understanding among advertisers. That’s clearly true,” says Tom Bowman, CEO at Intelligent Optimisations.

Bowman compares today’s state of programmatic to “almost like mobile” before the advent of the iPhone, anticipating that its “breakthrough moment” has yet to be realised; “it’s still in it’s fairly nascent state compared to search, which marketers are far more familiar with.”

IProspect’s display and programmatic director, Adam Taylor, believes the education problem is two-fold.

“In my opinion, advertiser knowledge of programmatic coupled with a skills shortage on both the buy and sell side is limiting the rate at which adoption can take place.”

Taylor says that most digital leads on the advertiser side tend to have stronger operational experience within ‘traditional’ digital channels, such as PPC and affiliate, but can lack the technological knowhow when it comes to programmatic – something which could, Taylor adds, “affect the biggest change for their business.”

AppNexus’ VP of strategic development, Nigel Gilbert, reminds us that with the IAB and PwC’s digital ad spend report predicting programmatic to creep up to a 80-90% share of display ad sales by 2019, neither advertisers nor agencies can afford to be unfamiliar with this technology.

“The lack of understanding has a negative knock-on effect on overall trust,” he continues; “in fact, our own study highlighted that only 20% of advertisers claimed to be totally confident in knowing how effectively their digital campaigns perform, whilst one in four advertisers have a lot of uncertainties.”

The “pressing need” for programmatic literacy should not only concern advertisers and agencies, it also needs to be reflected on the sell-side, where a considerable percentage of publishers eschewing the method risk being somewhat left behind as programmatic takes an increasing, if gradual, share.

‘Cannibalisation’

“The view from the sell-side is a little different,” says Victoria Swainson, 1XL’s head of programmatic, who doubts that there aren’t many publishers who are “at least” trading some of their inventory via programmatic buying.

Swainson argues that there will be some who are not willing to buy into the method fully, cautious that they could be putting ad space revenue at risk, while at the same time ramping up outgoings on the associated tech integration.

“Some are wary of cannibalising higher yielding direct-sold campaigns with ‘back door’ open RTB and no revenue guarantees,” says Swainson.

“It also takes significant resource to manage a programmatic stack well, such as managing multiple complex vendors, troubleshooting private marketplaces, yield optimisation and reporting.”

However, on the subject of technology Bowman argues that while programmatic buying is still perceived as a “complex process”, the reality is that it is one that’s “simplifying the digital media landscape immensely”. Its implementation, he continues, is a necessary learning curve if marketers are to make full use of the increasing deluge of consumer information.

“Due to the proliferation of data, we need powerful and sophisticated machines to be able to interpret this data and automate media buying decisions in real time in order to stay ahead of the game and maintain competitive advantage.”

Ad fraud, viewability

Cited among a weighty 17.9% of respondents, the second most highly-ranked answer was that programmatic has yet to shed a reputation for ad fraud and issues with display viewability, with one respondent claiming it’s of “little surprise” that the technique is being held back when only a third of impressions are served.

This was a point tackled in PerformanceIN’s viewability survey, where Sociomantic argued that programmatic ad serving is only as effective as the data it is fuelled by, suggesting advertisers can fund their way out of this conundrum if they cough up enough for impressions most likely to trigger conversions.

Nevertheless, it raises the question of whether the programmatic model is currently working and viable, if advertisers have to rely on its premium offering for ensuring things actually get seen.

On the subject of ad fraud, it’s clear the display industry as a whole is still weathering the issue, and its solution relies to a degree on the further development of digital trading standards in order to outlaw murky industry techniques, such as blackboxing, artificial floor pricing and undisclosed bidding fees.

Fuelling adoption

“Interestingly”, says Exchange Lab’s CSO and founder, Tim Webster, “most of the issues outlined in the PerformanceIN survey can be significantly reduced by focusing on one of those issues in particular – the lack of understanding among advertisers.”

Webster adds that addressing education in a “consistent and informative” way is the key to further fuelling programmatic’s adoption, and encouraging the movement of advertising dollars in the space.

“Part of this is moving the conversation away from ‘technology features’ to focusing on the needs of advertisers and the solutions that programmatic can deliver for marketers.”

According to Taylor, iProspect takes it on itself to “empower” clients with programmatic education, offering training platforms, demos and 101 sessions in a bid to encourage “healthy debate” on programmatic media planning and trading techniques.

“As with any ‘new’ line put on a media plan, understanding the value comes from a deeper understanding of the tech, data and tools used to reach a target audience, and programmatic is no different.”

“As an industry, we need to get better at recruiting and retaining talent on agency, publisher and advertiser sides as progression of smart technology requires smart people,” concludes Taylor.

Parting words

Despite the challenges at programmatic’s door, evidenced in the results of the survey, Swainson claims the buying technique can be an “alternative, highly measurable” channel of execution. She also believes the ‘tech tax’ on the advertiser side is a teething problem which will eventually get squeezed, leading to increased efficiency for both sides.

Gilbert’s view is that a wider education around the benefits of programmatic, hand in hand with improved viewability rates, will ultimately “unlock programmatic’s full potential”.

If you’re interested in conducting a research project with PerformanceIN, or commenting in our analysis, we’d like to speak to you – just email our editorial staff at content@performancein.com