Real-time football data startup Squawka, which acts as a web-based second screen platform for viewers of live televised sport, has secured an investment boost from a cluster of performance marketing and advertising businesses.

The London-based firm was co-founded by ex-network director at Tradedoubler; Sanjit Atwal, and the creator of performance marketing search agency, Found; Leo Harrison.

The duo have successfully attracted a cash injection from the likes of Forward Internet Group, which owns the likes of the uSwitch comparison site and digital agency Forward3D. E-commerce marketing technology company FusePump is also a stakeholder, but investment figures have not been revealed.

The company has also gained several new board members.

Forward Internet Group’s founder Neil Hutchinson, has been appointed to the board, as has FusePump’s chief executive officer Rob Durkin. Sir John Hegarty, whose agency BBH is now owned by Publicis Groupe, is also now a shareholder.

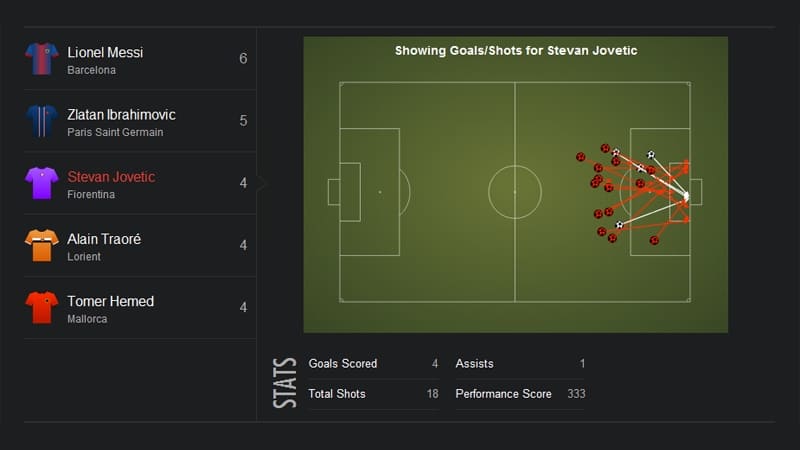

Data Visualisations

Hutchinson said: “We have worked with Leo, Sanjit and their team in the past, and are excited about their vision for the Squawka community. The early data we have seen around user engagement and viral growth since we first invested has been impressive and we look forward to the next part of the journey.”

Lastminute.com and notonthehighstreet.com investor, Thomas Teichman, has been appointed chairman for Squawka, Spark Ventures director Kiko Duffy, and entrepreneurs Eric Lumley and Jay Taylor, have also join the board.

Squawka, which launched in June 2012, provides real time data visualisations of football matches across Europe alongside social media.

Since launching, the web application has experienced a large take-up and boasts an average dwell time of 39 minutes during English Premier League games. It has a user base spanning 192 different countries around the world.

“As well as being great fun for any football fan, Squawka is a web application that demonstrates the power of visualisation to the everyday person.,” Durkin said.

“The potential of Squawka to capitalise on the second screen phenomenon with quality relevant advertising made investing in it a no-brainer for me.”