At Affiliate Window we’ve been focusing on several niche sectors with the advertisers we work with. The aim of these reports has been to shed greater light on the nuances seen within these specific advertisers, who quite often differ from the typical retail, travel and finance affiliate trends, and to provide sector-specific actions for programme managers.

This series looks at variety of sub sectors, taking into consideration online market reports in tandem with typical affiliate reporting metrics such as conversion, AOV, growth/decline curves and device sale splits. This report analyses the US Apparel market.

The US Apparel sector has seen substantial growth in the past few years, with annual growth at 3% in 2014 and 4.6% into 2015 according to MarketLine. The same research suggests the sector will reach a collective value of $1,650bn by 2019. With a strong US Dollar, and big brands such as Zara and Uniqlo investing in the region, brands are continuing to export more apparel goods to the US, helping sector growth (Business of Fashion).

Trends in the Apparel vertical are constantly changing, and brands must work hard to meet growing consumer requirements for fast and seamless online transactions as well as provide highly customizable delivery options. As the sector becomes increasingly dynamic, fashion retailers such as Calvin Klein are now starting to use the latest trend data from Google to meet ever changing patterns and customer search trends. Google’s spring 2015 fashion search trend report is available here.

Coupled with widespread adoption of 4G smartphones, mobile e-commerce has grown at 19% in the past four years and now accounts for 36.9% of visits to US online stores. At Affiliate Window in July 2015 mobile (smartphone & tablet) contributed to 26% of total Apparel sales, with 27% of total traffic for the same period.

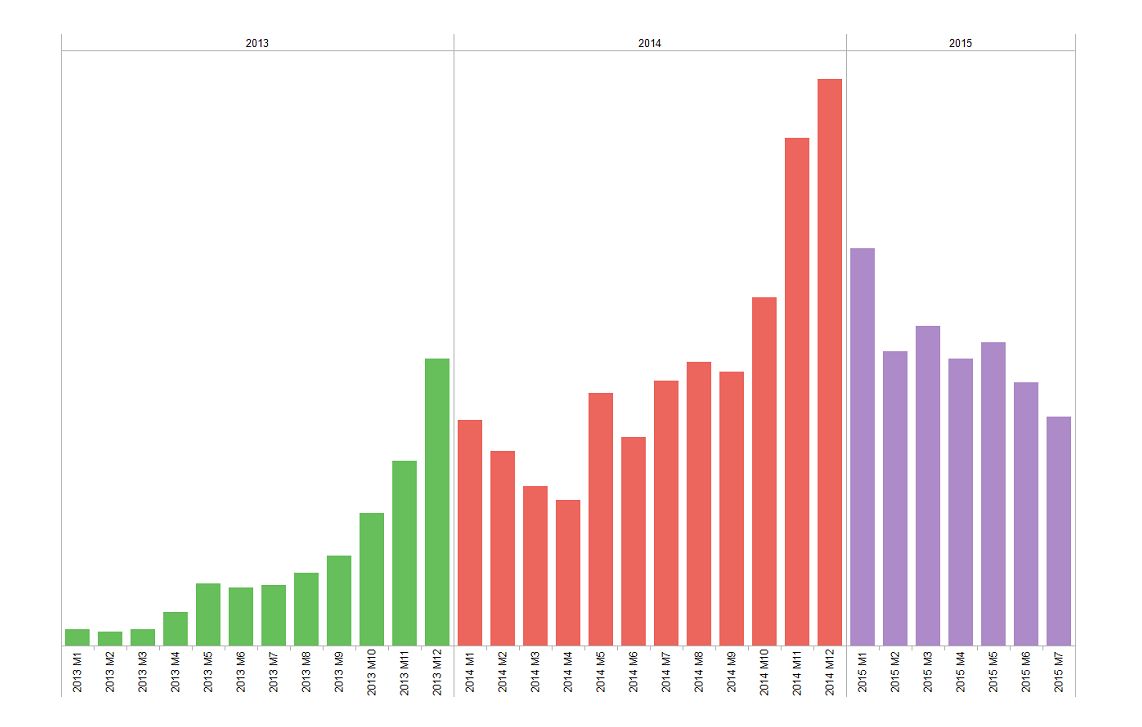

Moving into Q3 for the Apparel sector, we are anticipating strong performance again around numerate peak sale periods such as Black Friday and Cyber Monday. An article published by Internet Retailing, predicts up to quadruple growth from 2014 to 2015. While we would unlikely see this growth across all sectors, our growth in the Apparel sector revenue below looks promising, where we’ve seen year to date growth at 88% already in 2015.

Trends over time: The graph below indicates the monthly revenue trend for Affiliate Window’s Apparel advertisers:

Key performance indicators

Average Order Value (AOV)

While revenue and sales have increased since 2013, AOVs have dropped slightly in the sector from an average of $117.57 in 2013 to $105.67 in 2015.

Conversion rate

The average conversion rate for 2015 has seen a slight decline from 3.41% in 2013 to 3.04% year to date in 2015. Looking across the year we see higher conversion rates around November peak and Christmas, indicating the total 2015 conversion rate may rise further.

EPC and commissions

With strong growth in sales and revenue, the average EPC has seen a slight increase from $0.26 in 2014 to $0.27 in 2015 year to date, which as with conversion rate, may grow further as we enter retail peaks in Q4. Average commissions have also slightly increased from $8.65 in 2014 to $8.85 in 2015 year to date.

Mobile performance

Smartphones have slowly increased in their portion of traffic with 15.70% of total clicks in 2015 compared to 14.28% in 2013. Smartphone sales have increased further rising from 7.27% of total sales in 2013 versus 16.06% this year.

Tools for affiliates

Typically most Apparel programmes will offer affiliates a product feed, standard banner creative, coupon codes, promotional campaigns and text links.

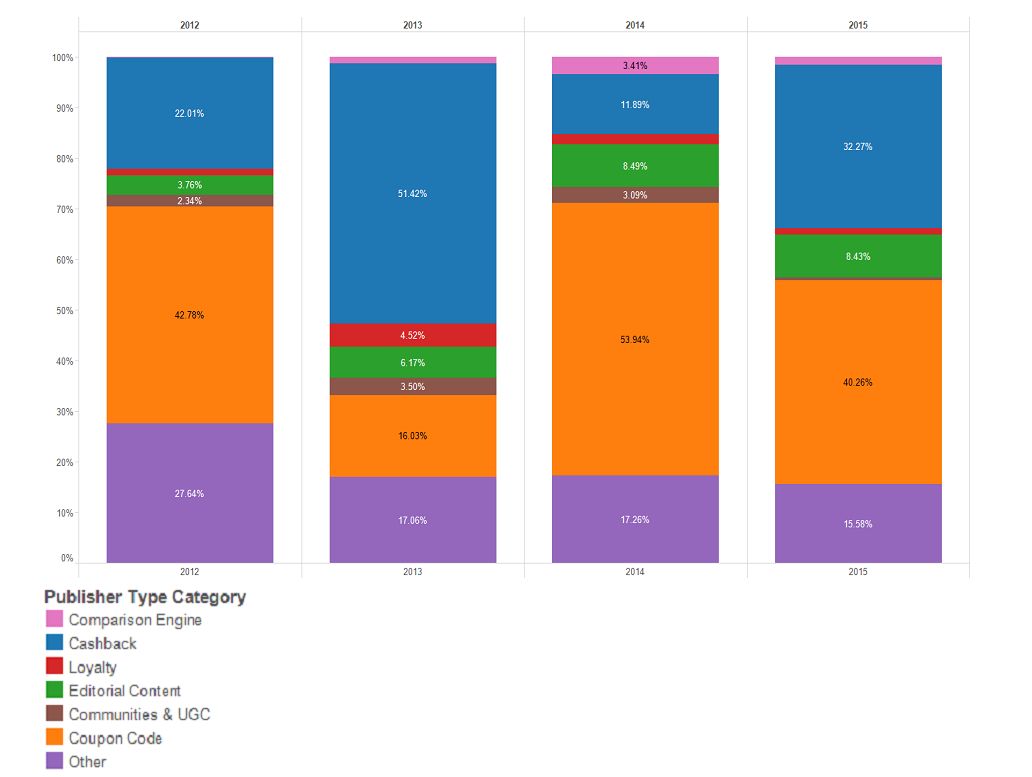

Affiliate mix

In the chart below, we’ve broken out the percentage of affiliate’s transactions by publisher type. Cashback has increased notably in 2015 rising to 32.27% of total sales, while coupon code has dropped from 53.94% to 40.26%. Editorial content sites have maintained a similar share over the past two years, where loyalty and comparison engine have seen a drop. Q4 sale periods may impact the total year end split for 2015.

Finally, we’ve put together some niche sites to consider for the sector: